ESG

VIXAR positions itself as an “ESG focused fund” and follows an ESG thematic investing thesis throughout the investment cycle from investment selection, portfolio management, shareholder advocacy to exit management.

VIXAR has a robust reporting framework including ESG reporting under its Environmental and social management policy (ESMS) which is based on NIIF, IFC and other DFI ESG guidelines.

VIXAR firmly believes that Environmental, Social and Governance (ESG) parameters are integral to its role as an investor. Integrating ESG factors in investment decisions is vital in determining risks and opportunities, and ensuring long-term, sustainable value creation for the fund, for its portfolio companies, their management and employees, the environment, and society as a whole. Fund’s approach towards ESG is embedded in all aspects of its investments process from initial investment selection, to subsequent value creation and exits, ensuring a sustainable long-term ownership structure into the future. Somerset Indus’s approach towards ESG investing flows from its Environmental and social (E&S) policy which is documented as its Environmental and Social Management system (ESMS).

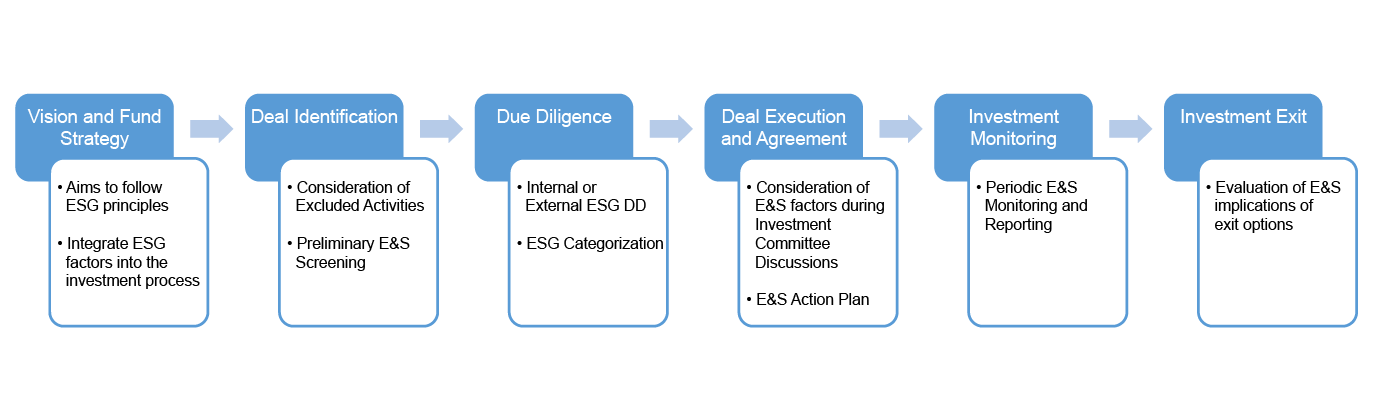

ESG is tightly integrated into our Investment cycle

VIXAR’s commitment to ESG is intertwined into every step of its journey. The process begins with initial screening by applying negative screening principles to gently set aside opportunities with sectors covered under the exclusion list. Post that, for pre-investment evaluation, careful discernment is based on third party ESG & Impact due diligence and reviews with detailed E&S Action Plan (ESAP).

Post-investment, the fund leverages its deep relationships with management, CEOs, and Boards of investee companies, promoting effective ESG risk management. SageRock helps strengthen the Governance and risk profile by enabling development of robust policies and internal management systems.

Once the risk profile is strengthened, the fund supports portfolio companies to E&S maturity and help redefine strategy for value creation. The in-depth understanding of business, sector insights and risk profiles helps the fund to unlock opportunities for value creation for stakeholders.